![]()

|

Alita Resources (ASX: A40) [Shares: 1476M at 24 Jul 2019] |

|

| Date / Location of update |

Comments |

18th December 2019, Weekly Update (Stock price: A$0.00) | Alita Resources (A40.AX), the junior Australia-based lithium producer in the TSI Stocks List, almost certainly will be a total write-off for shareholders. The reason is that the Deed of Company Arrangement (DoCA) proposed by China Hydrogen Energy Limited (CHEL) was approved by creditors at a meeting earlier this week. Under this DoCA, some A40 creditors will be paid only 10c on the dollar. This implies that the shares are worthless, because creditors get paid in full before shareholders are entitled to anything. Unless something extraordinary happens, the shares will be delisted and transferred for nil consideration to the new owners of the company. This means that Galaxy Resources (GXY.AX), A40's largest shareholder, played its hand poorly. GXY purchased A40's secured debt in August to ensure (we assume) that it was in the prime position to take control of A40's Bald Hill lithium mine, which is located in the same 'neck of the woods' as GXY's Mt Cattlin lithium mine. This was a miscalculation by GXY's management, as a loan to A40 from the Chinese company mentioned above enabled the repayment of the secured debt held by GXY and left GXY in the same position as other shareholders. When we added A40 to the TSI List in June of this year the company had just raised A$32M via an equity financing and GXY had become A40's largest shareholder. Our thinking at the time was that the financing had eliminated short-term balance-sheet risk and that GXY eventually would make a take-over bid for A40. We were wrong on both counts. It is said that every cloud has a silver lining. If there is a silver lining here it's that the A40 saga prompted us to look more closely at GXY than we otherwise would have done and has made us aware of a very under-valued situation. GXY's management stumbled in its A40 dealings, but other than that it has done well over the past few years. The company now has a very strong balance sheet and three high-quality lithium assets, including a cash-flow positive spodumene mine in Western Australia. There will be a write-up on GXY in the coming Weekly Update, but suffice to say at this time that our conservative, albeit rough, valuation for the stock is A$2.50/share. This compares very favourably with the stock's current A$0.93 market price. We think that the market price will reach our valuation within 18 months IF (a big if) the lithium market is not far from its cycle trough. We continue to think that Mineral Resources (MIN.AX) provides the lowest-risk exposure to lithium, but MIN doesn't have anywhere near the upside potential of GXY by virtue of it being nowhere near as leveraged to the lithium price. Furthermore, whereas MIN is trading near a 52-week high, GXY is trading near a multi-year low. We have added GXY to the TSI List at the current price of A$0.93. |

9th December 2019, Weekly Update (Stock price: A$0.08) | Early last week Galaxy Resources (GXY.AX) confirmed that its senior secured loan in the amount of US$32M (about A$47M) to A40 had been repaid in full. This came about because a Chinese company has effectively recapitalised A40 by providing a loan in the amount of A$70M. GXY has recovered its short-term investment in A40's debt, but stands to lose up to 100% of its A$40M investment in A40's equity. This means that GXY is now in the same boat as all other A40 shareholders. It therefore looks like GXY's management has miscalculated, given that it purchased A40's debt with the aim of protecting its equity investment and ensuring that it was in the prime position to gain ownership of A40's Bald Hill lithium mine. |

2nd December 2019, Weekly Update (Stock price: A$0.08) | We had expected that Galaxy Resources (GXY.AX), as A40's sole secured creditor, would end up with ownership of A40's lithium production assets, but it now seems that won't be the case. According to a press release last Friday: "...Alita and certain of its subsidiaries have entered into a binding AUD$70 million loan facility agreement ('Loan Facility Agreement') with China Hydrogen Energy Limited ('CHE') and related security arrangements. The funds available under the Loan Facility Agreement will be applied by Alita to repay in full all amounts outstanding under the senior secured debt facility with its secured creditor, Galaxy Resources Limited ('Galaxy Facility'). The balance of the Loan Facility Agreement is available for draw down for working capital purposes, subject to the consent of CHE. The Loan Facility Agreement contemplates that CHE or its nominee will submit a deed of company arrangement proposal ('CHE DoCA') for consideration by the Administrators and creditors of the Group." We don't know what this means for the value of A40 shares or even if the shares will trade again. More information is required and should be forthcoming within the next few weeks. Also, we note that GXY shares were halted on Friday pending an announcement regarding the company's investment in Alita. The GXY announcement is expected to be made prior to the start of trading on Tuesday 3rd December. |

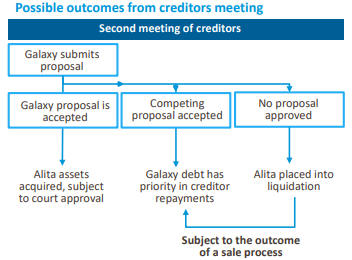

25th November 2019, Weekly Update (Stock price: A$0.08) | Alita Resources (A40.AX), a junior Australia-based lithium miner, was placed into administration in August and has since been immersed in restructuring proceedings. Galaxy Resources (GXY.AX), a mid-tier Australian lithium miner, is the sole secured creditor to A40 and as such has substantial influence on the end result of these proceedings. The following flow chart from a recent GXY presentation (refer to p37 of the document posted HERE) summarises the three possible outcomes from the restructuring proceedings and the associated meetings of creditors. Either of the first two outcomes could result in the company's shares retaining some value, but at this point there is no guarantee that shareholders will salvage anything. It's likely that the result of the restructuring process will become known before year-end.  It's reasonable to assume that one way or another GXY will end up with ownership of A40's assets at a cost that is well below the potential long-term value of these assets. Also, thanks to the GXY stock price having dropped by around 80% from its early-2018 peak (see chart below) the company's existing assets (refer to the presentation linked above for information) now appear to be trading at a large discount to their potential long-term value. Moreover, GXY has a strong balance sheet, with net cash of about A$200M (around A$0.50/share), which should enable the company to weather the on-going price weakness in the lithium market caused by a temporary supply glut. As a consequence, GXY appears to have a very attractive intermediate-to-long-term risk/reward near its current price. For long-term exposure to lithium we think it would make sense to accumulate GXY near its current price of A$1.00 and to 'back-up the truck' if the stock price drops to near the company's cash value of A$0.50. |

2nd September 2019, Weekly Update (Stock price: A$0.08) | Alita Resources (A40.AX) had very bad news last week. First, there was an announcement that Galaxy Resources (GXY.AX), Alita's largest shareholder, had purchased Alita's A$40M of secured debt. This wasn't inherently bad news, but GXY subsequently prevented A40 from completing a financial restructuring with a consortium of lenders/investors by refusing to extend a standstill agreement. This caused A40's management to put the company into Voluntary Administration, which was followed by GXY (the senior secured creditor) appointing receivers and managers. It's almost certain that GXY will end up with control of A40. This is what we expected would happen when we added A40 to the TSI List, but obviously we didn't think it would happen in this way (we thought that GXY eventually would make a takeover bid). A40's financial troubles grew incredibly quickly. When we added it to the List just three months ago it had just completed a substantial equity financing at A$0.20/share and appeared to be in good shape, but an inability to sell the output of its lithium mine in a timely manner put the company in breach of debt covenants and led to the current circumstances. There still could be significant value in Alita for minority shareholders, but the amount won't be known until the company is restructured and this could take at least a few weeks. |

26th August 2019, Weekly Update (Stock price: A$0.08) | Alita Resources (A40.AX) provided updates on its progress. Since the beginning of this month the company has made two shipments to its current main off-take partner Jiangxi Bao Jiang Lithium Industrial Limited (JBJLIL). The first was 10,000 tonnes priced at US$680/t in early August and the second was 10,500 tonnes price at around US$610/t on 19th August. We estimate that the combined value of the shipments was about A$19.5M and that after the deduction of deferred payments A40 would have received about A$17.1M. We expect that an announcement regarding the company's refinancing and off-take arrangements will be made this week, enabling the stock to resume trading. Once we have the information we'll assess whether it makes sense to average down on this stock. The main problem for A40 and all lithium miners is the on-going lithium supply glut, which is keeping downward pressure on the price. |

19th August 2019, Weekly Update (Stock price: A$0.08) | Alita Resources (A40.AX) has requested (and been granted) the suspension of trading in its shares pending an update regarding the previously announced Strategic Review, offtake arrangements, operations at the Bald Hill Mine and discussions with the Company's lenders. The voluntary suspension will remain in effect until the earlier of an announcement to the market or 3rd September 2019. We don't have any non-public information regarding what the company is planning/negotiating and don't expect to know more until the above-mentioned announcement is made. |

5th August 2019, Weekly Update (Stock price: A$0.08) | Alita Resources (A40.AX) advised that it has it has received a letter of credit for the shipment of approximately 10,000 tonnes of lithium concentrate to its main off-take partner (Jiangxi Bao Jiang Lithium Industrial Limited - JBJLIL). The vessel was scheduled to leave the Port of Esperance by 2nd August, so we assume that the product is now on its way to China. No dollar amount was mentioned, but this shipment should bring somewhere between A$8.5M and A$10M into the company. This reduces short-term risk, but Alita must identify other sale opportunities over the next few months to reduce the existing stockpile (still more than 30,000 tonnes after last week's shipment) and establish longer-term offtake contracts. |

29th July 2019, Weekly Update (Stock price: A$0.09) | Alita Resources (formerly Alliance Mineral Assets) (A40.AX) published its quarterly report for the June-2019 quarter and advised that it has initiated a strategic review in response to challenging conditions in the lithium market. During the latest quarter A40's production from its Bald Hill mine in Western Australia was about 39,000 wet metric tons (wmt) of lithium (spodumene) concentrate, a new record. The production cost was US$545 per wmt. The company consumed about A$18M of cash during the June quarter and has since consumed an additional A$13M of cash, leaving it with a cash balance of A$16.6M at 25th July. The reason for the rapid cash depletion isn't a high cost of production, but a mismatch between production and sales. The company only shipped about half of what it produced during the June quarter and has not shipped anything to date during the September quarter. As a consequence, it has stockpiled about 40,000 wmt of lithium concentrate that we estimate has a market value of about A$30M. In other words, it has incurred all the costs to produce about 40,000 tonnes of lithium concentrate but is yet to receive any of the revenue associated with this production. Clearly, management will have to do a better job of arranging off-take agreements to match cash out-flows with cash in-flows. News regarding the costs-revenue mismatch and the related rapid cash depletion caused the A40 stock price to plunge over the final two days of last week. We like to take advantage of large price declines that occur with no significant deterioration in fundamentals, but we have not bought in response to last week's sharp decline in the A40 share price. This is because we don't have enough information on the timing of A40's future revenues to fully assess the risk of a cash crunch. The short-term risk is that A40 could breach its debt covenants by 1st October if it can't find a buyer for its stockpile. The company expects to ship 10,000 tonnes of concentrate to its Chinese offtake partner Jiangxi Bao Jiang Lithium Industrial (JBJLIL) early next month. Also, it advised that if it is unable to finalise the JBJLIL delivery as planned or schedule a replacement shipment to the same timing, it "will implement alternative measures to seek to manage its cash flow position, including other shipments and sales revenue generative options." Pilbara Minerals, another Western Australia-based producer of lithium concentrate, faces a similar problem at its Pilgangoora mine near Port Hedland, with stockpiles of unsold spodumene concentrate continuing to build. More than 50,000 tonnes of the concentrate is now stockpiled at the mine. The overarching issue is that the global supply of lithium has been increasing faster than the demand for the metal. In addition to applying downward pressure to the price, this is making it difficult for some smaller and newer producers to find buyers for their product*. In A40's case, the best solution may be to sell itself to a larger and financially-stronger lithium miner, with Galaxy Resources (GXY.AX) being the most obvious choice given that GXY recently purchased about 12% of A40 at more than double A40's current stock price. *This is an issue that gold producers never have to consider. It is always easy to find buyers of gold. |

22nd July 2019, Weekly Update (Stock price: A$0.13) | Alliance Mineral Assets (A40.AX) has changed its name to Alita Resources. The name change was approved by shareholders at a meeting on 11th July. Obviously, the name change has no effect on the company's valuation or prospects. |

15th July 2019, Weekly Update (Stock price: A$0.14) | Alliance Mineral Assets (A40.AX) reported June-quarter lithium concentrate production from its Bald Hill mine that was roughly the same as the March quarter, enabling the company to achieve a production result for the first half of CY2019 that was close to the top of its guidance range. Specifically, during the first half of this calendar year A40 produced 78,937wmt (wet metric tonnes) of 6.0% Li2O-equivalent versus guidance of 65,000-80,000 wmt. This constitutes a solid production performance, although production costs won't be known until the end of this month and the complete financial picture won't be known until the annual financial report is published in September. Production for the next 6 months is expected to be similar to production over the past 6 months. We are comfortable with the way A40 is performing on the ground, but like all lithium producers the company is struggling against market headwinds in the form of a downward trending lithium price. There's a high probability that it eventually will be taken over by either Galaxy Resources (GXY.AX) or Mineral Resources (MIN.AX), two companies that have lithium mines in the same part of Western Australia as A40's Bald Hill project, but hopefully the takeover will happen during a more bullish period for lithium miners. |

5th June 2019, Interim Update (Stock price: A$0.18) | A40 is a junior Australian lithium producer that we introduced in the 8th May 2019 Interim Update. The initial write-up can be found at https://www.speculative-investor.com/new/A40.html. In the 13th May Weekly Update we then wrote: "A40 will be added to the TSI List as a long-term position IF it trades at A$0.18. At that price we think it has 1-2 year upside potential of at least 200%." Since that time, two things have happened. First, A40 raised A$32.5M via an equity financing priced at A$0.20/share, with mid-tier Australian lithium producer Galaxy Resources (GXY.AX) being the major participant in the financing. GXY now owns 12% of A40 and probably (we think) will make a takeover bid for A40 within the next two years. Second, on 5th June the stock traded at our stipulated buy price (A$0.18) and therefore has been added to the TSI List as a long-term position. . |

13th May 2019, Weekly Update (Stock price: A$0.21) | In last week's Interim Update we wrote about A40 Mineral Assets (A40.AX), a junior lithium producer based in Western Australia. The stock price rebounded from a late-April low of A$0.16 to an intra-day high of A$0.24 last Friday, but it is now pulling back. A40 will be added to the TSI List as a long-term position IF it trades at A$0.18. At that price we think it has 1-2 year upside potential of at least 200%. |

8th May 2019, Interim Update (Stock price: A$0.21) | With Kidman Resources (KDR.AX) in the process of being taken over at a large premium and the prices of most other lithium stocks at depressed levels, this is a good time to introduce another company that provides exposure to the most important EV battery metal. The company is Alliance Mineral Assets (A40.AX). A40 has 1,305M shares on issue, A$15M of cash and A$40M of debt (meaning: net debt of A$25M). Like KDR's Mt Holland project, A40's Bald Hill project is located in the south-eastern part of Western Australia (WA). The following chart shows the location of Bald Hill and other major WA lithium projects. Unlike KDR, which is just entering the mine and plant construction phase, A40 is already in production.  Source: A40 Presentation A40 recently went into production. It is on target to produce about 80K tonnes of spodumene concentrate grading >6% lithium (Li2O) during the first half of this calendar year (CY). Also, it expects to produce 180Kt of concentrate during CY2019 and 240Kt of concentrate during CY2020. About half of its 2019 and 2020 production is committed under an offtake agreement with Jiangxi Bao Jiang Lithium Industrial Limited (JBJLIL), a JV between Burwill Lithium Company Limited and lithium industry specialist Jiangxi Special Electric Motor Co. Ltd (JSEMC). This agreement sets minimum and maximum prices of US$680/t and US$1080/t. A40's operating costs are forecast to be US$585/t in CY2019 and US$400/t in CY2020. Assuming that it receives the minimum offtake-agreement price of US$680/t for all of its production, this implies an operating (gross) profit of about US$17M (A$24M) in CY2019 and US$67M (A$93M) in CY2020. Now assuming that the company is worth 8-times its annual gross profit we come up with a rough value of A$744M, or A$0.57/share. The current share price is A$0.18, so this roughly-estimated value implies upside potential of about 200% over the next 18 months. There is execution risk, in that things could go wrong in the production ramp-up and costs could be higher than expected. There is also financing risk, in that repayment of the company's A$40M debt is due on 1st July 2020. On the other hand, there are opportunities. For example, about two weeks ago A40 entered into a non-binding memorandum of understanding (MOU) with JSEMC regarding a 50/50 joint venture to produce and sell battery-grade lithium hydroxide (LiOH). The intention is that A40 and JSEMC will share equally in the margin from sales of LiOH after recovering their respective costs -- the cost to A40 of producing the lithium concentrate and the cost to JSEMC of converting the concentrate to battery-grade LiOH. If this proposed arrangement comes to fruition it probably would result in much greater profitability for A40. For another example, A40 is a potential takeover target by virtue of the Bald Hill project's location relative to the lithium mines operated by larger companies. Mineral Resources (MIN.AX) and Galaxy Resources (GXY.AX) are the most likely acquirers. A40's stock price has trended downward with the lithium price since early last year. It may have hit rock bottom over the past few months, although there is a risk that a poorly timed financing could push it lower. We like the risk/reward near the current price. Note that when we wrote the above on Wednesday morning Australian time (Tuesday night in the US), the stock was trading at A$0.18. Unfortunately, it has since jumped 20% to A$0.215. The risk/reward remains very attractive, though, albeit slightly less so due to the quick up-move. It still could be worth taking an initial position near the current price with the aim of scaling in over the next several months.  |