|

- Interim Update 7th May 2003

The US

Stock Market

Don't worry, be happy

Over the past year, two of the most

powerful trends in the financial markets have been the downward trend in

the US$ and the upward trend in the bond market. It seems to make sense,

therefore, to conclude that when things really do start to get better we

will see a change in at least one these trends, that is, we will see the

dollar start to strengthen and/or bonds start to weaken. As discussed in

last week's Interim Update, one way to determine if this is happening is

to look at the bond/dollar ratio (the price of a 30-year Treasury Bond

divided by the Dollar Index).

Last week we included a chart of the

bond/dollar ratio to highlight what we consider to be an important non-confirmation

of the stock market's rally. In a nutshell, the powerful up-trend in the

bond/dollar ratio caused by a strengthening bond market combined with a

weakening US$ was showing no signs of abating. In fact, the ratio appeared

to be headed for a new high. This was, in our opinion, one piece of evidence

that the stock market's rally was based far more on hope than on any genuine

improvement in the fundamentals.

We'll now take another look at the

relative performances of bonds and the US$, this time over a longer period

of time and using the dollar/bond ratio as opposed to the bond/dollar ratio.

There are two points we want to make

with respect to the below chart of the dollar/bond ratio (note, by the

way, the line on the chart rises when the US$ is rising relative to US

bonds). First, as if in mockery of the 'feel good' rally that has occurred

in the stock market, the dollar/bond ratio has just sunk to a new low for

the year. This is a glaring divergence - either the currency and bond markets

are completely wrong or the stock market is wrong. Second, the dollar/bond

ratio has just moved down to near the level that was reached during the

height of the August-October 1998 financial crisis (when the Asian currency/debt

crisis, a Russian debt default and the failure of a massive hedge fund

combined to almost bring down the house of cards known as the world's financial

system). At that time, fear was rampant in the stock market (the VIX was

above 50 and 48% of the newsletter writers surveyed by Investors' Intelligence

were bearish) and stock prices were plunging. Now we have a similar extreme

in the dollar/bond ratio, once again indicating a crisis, but this time

stock-market participants couldn't be more complacent (the VIX is around

23 and only 24% of newsletter writers are bearish).

When the crisis dissipated in 1998

the dollar/bond ratio moved sharply higher, as did the stock market. Note,

though, that the stock market wasn't able to begin its recovery in 1998

until the dollar/bond ratio turned higher. As long as the dollar/bond ratio

was falling the stock market remained under immense pressure. Today, however,

the things that are causing the crisis (economic weakness in most of the

major economies and the massive US current account deficit) obviously aren't

perceived to be big problems for stock market. That, however, will change.

Another non-confirmation of the

bulls' case

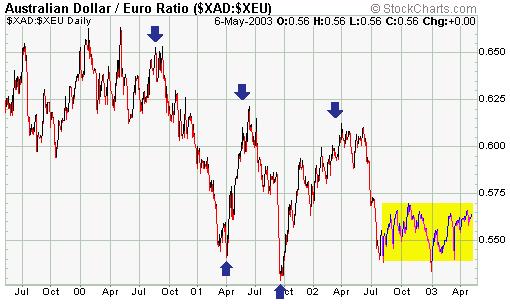

While we are on the subject of non-confirmations,

lets take a look at a chart of the A$ in terms of the euro (the below chart

shows the number of euros per Australian Dollar, so the line on the chart

rises when the A$ is rising relative to the euro). Over the past few years

the A$ has out-performed the euro during periods of stock market strength

and under-performed during periods of stock market weakness. For example,

the important stock market peaks in September-2000, May-2001 and March-2002

(identified by the down arrows on the below chart) corresponded very closely

with peaks in the euro/A$ exchange rate while the important bottoms in

April-2001 and September-2001 (identified by the up arrows on the below

chart) corresponded almost exactly with troughs in the euro/A$ exchange

rate. Also, huge rallies in the A$, relative to the euro, followed the

intermediate-term bottoms in the stock market that occurred in April and

September of 2001. However, there clearly hasn't been anything similar

over the past 9 months (the shaded area on the chart). In fact, the chart

of the euro/A$ rate reveals the same sideways trading since last July as

the chart of the S&P500 Index.

The above chart is actually consistent

with the generally sideways action in the stock market, but it is inconsistent

with the prevailing stock market sentiment.

Current Market Situation

Below is a chart showing the NDX/Dow

ratio (the NASDAQ100 Index divided by the Dow Industrials Index). The uptrend

in the NDX/Dow ratio is one of several signs that investors have become

less risk averse over the past several months (the NASDAQ100 stocks are

generally considered to be more risky than the Dow stocks). Furthermore,

the early and middle stages of all the major declines over the past 3 years

have been characterised by weakness in the NDX relative to the Dow. Therefore,

and as discussed on many occasions since late February this year, as long

as the uptrend shown on this chart remains intact we shouldn't get excited

about the prospect of another major decline in the stock market (a drop

in the stock indices to well below last October's lows).

Further to the above, a decline in

the stock market over the next few weeks that does NOT result in a break

of the uptrend in the NDX/Dow ratio is probably going to create a buying

opportunity for short-term traders. Note: Given how bullish most traders

currently are, a pullback has a very high probability of occurring over

the next 1-2 weeks.

Several weeks ago we mentioned that

the stock price of the world's largest company (Walmart) had been a reasonable

leading indicator for the overall market over the past year or so because

it had peaked and troughed in advance of the S&P500 Index. We also

mentioned that a new recovery high in the S&P500 Index that was not

confirmed by a new recovery high in the Walmart stock price would be a

sign of trouble for the market.

Interestingly, this week's new high

for the S&P500 Index was not confirmed by a new high for WMT. As the

following chart shows, WMT peaked at the end of April in the midst of a

resistance range. It is too early to know whether this non-confirmation

of the recent new high in the S&P500 is important because WMT might

just be pulling back in preparation for another rally. However, the significance

of this non-confirmation would increase if WMT now closes below its April

low ($51.50).

Bond market

Update

The below chart of June bond futures

shows that bonds made a new high for the year on Wednesday. This is surprising,

to say the least, considering that the stock market had moved to a new

recovery high just one day earlier.

We can come up with three possible

explanations for the recent strength in the bond market. They are:

a) The inverse relationship between

stocks and bonds that has dominated the financial landscape since 1998

is no longer in effect and bonds have begun to respond to economic fundamentals.

b) The Fed is surreptitiously following

through on its threat to cap long-term interest rates at an artificially

low level by buying bonds.

c) A huge divergence is building and

this divergence will be resolved, in the near future, by a sharp drop in

stock prices OR a sharp drop in bond prices.

Of the above, explanation a) is the

least likely. In the absence of a panic that pushes money towards the lowest-risk

investments it is extremely unlikely that US bonds would remain strong

in the face of such a weak US$. We are clearly NOT in the midst of a panic

at this time. In fact, as we've pointed out many times over the past 2

months there are definite signs that investors are becoming less risk averse,

not more risk averse. We would take explanation a) more seriously, though,

if at some stage we witnessed just one trading day during which both stocks

and bonds dropped sharply.

Explanation b) has the advantage of

explaining how US bonds could be so strong in parallel with both a plummeting

US$ and a rising US stock market since any effort by the Fed to cap long-term

rates would encourage foreign investors to exit dollar-denominated debt.

If this explanation is the correct one then the dollar will remain very

weak, bonds will remain surprisingly strong and the stock market will not

plummet in the short-term. Also, the gold price should soon start to show

considerable strength because it is the one currency that central banks

can't create out of thin air and, therefore, can't devalue at will.

At this stage we think explanation

c) is the most likely. However, if the market believes the Fed is

capping long-term interest rates by buying bonds, or that it will do so

in the future, then this belief will certainly be contributing to the bond

market's rally.

Gold and

the Dollar

Currency Update

Since early last month our expectation

has been that the Dollar Index would bottom in the 95-96 range during May.

We are obviously now in May and the Dollar has fallen to the 95-96 range,

so this is not the time to be aggressively bearish on the dollar as far

as the short-term is concerned. However, as discussed in the latest Weekly

Update a near-term spike below 95 is a definite possibility. In fact, a

drop down to our long-standing target of 90 would be technically perfect

and would set the stage for a substantial counter-trend rally.

The below monthly chart of the Dollar

Index shows the break of the long-term uptrend that occurred during the

final quarter of last year as well as the major support corresponding to

the 1998 and 1995 lows. In our opinion the US$ would be a strong BUY in

the 90-92 range in anticipation of a multi-month counter-trend rally.

However, the term 'counter-trend' must be emphasised because last year's

break below the major upward-sloping channel projects an eventual decline

to the 1995 low.

Gold doesn't move inversely to the

US$ so much as it moves in the same direction as the Swiss Franc (gold's

positive correlation with the SF is much stronger than its negative correlation

with the Dollar Index). For this reason we spend more time looking at charts

of the SF than at charts of any other currency. Interestingly, the sharp

decline in the gold price in terms of the euro over the past few months

has been mirrored by a sharp decline in the SF relative to the euro.

What appears to have happened since

the beginning of this year is that the relatively weaker currencies have

made catch-up moves against the currencies that had previously been relatively

stronger. For example, coming into this year gold and the SF were the two

strongest currencies while the C$ was one of the weakest, but since the

start of this year we've seen the euro and the A$ make up some ground against

gold and the SF while the C$ has made up ground against almost all other

currencies.

Gold Stocks

From the latest Weekly Update: "Two

weeks ago it looked like gold stocks were in the early stages of a rally

that would take the HUI to a new high over the next few months. However,

although gold stocks recovered nicely during the second half of last week

the entire rally since the 13th March low is starting to look more like

a rebound within a continuing downtrend than a new uptrend. This view would

be reinforced if the HUI turns lower from at or below the top of the channel

shown on the below chart. And a move below the bottom of the channel would

strongly suggest that the 13th March low was not the final low for the

correction that began in January."

As the following chart shows, the HUI

hit its short-term channel top on both Tuesday and Wednesday before reversing

lower. This, in turn, improves the chances that the rally since 13th March

has been a counter-trend move and not the initial stage of a new uptrend

as previously suspected.

As discussed in the Weekly Update,

we do not think that a drop below the 13th March low would have long-term

bearish implications for gold stocks. In fact, a pullback to around the

105 level in the HUI over the next few months would potentially be far

more bullish, as far as the next 1-2 years are concerned, than would a

near-term surge above the May-2002 and January-2003 peaks.

Note that the possibility of

a drop below the 13th March low won't become a high probability

until after the HUI moves below the bottom of the channel shown on the

above chart, but if you feel over-committed to gold stocks then it is better

to get your house in order while prices are higher than to wait for confirmation

of the short-term bearish case. By the way, as previously mentioned we

don't plan to do any significant selling of junior gold stocks in our own

account. We have purchased these stocks in anticipation of MUCH higher

prices over the next 2 years and would welcome another opportunity to add

to existing holdings over the next few months. However, in order to be

comfortable enough to ride-out the periodic gut-wrenching declines in these

stocks you need to fully understand the big picture and you must have plenty

of cash in reserve.

Gold and Silver

The gold price has moved quietly higher

in 'stair step' fashion since bottoming in early April (see daily chart

of June gold futures below). It jumped above its 50-day moving average

last week and has subsequently consolidated within a narrow range around

$342. A breakout from this range will very likely occur within the next

3 trading days.

So far gold has done nothing to negate

our forecast for a move up to around $360 within the next few weeks, although

given the price action in gold stocks and the likelihood that the US$ is

close to an important low we don't think this is a great time to be buying

gold for a short-term trade.

In the latest Weekly Update we noted

that silver had moved up to resistance in the 4.80-4.90 range and said

"...if

the recent rally is going to fail then now is a likely time for it to do

so. As is the case with the Yen, there is little to be gained by trying

to anticipate an upside breakout in the silver price because the move following

a breakout will be substantial in terms of both time and price." There

is nothing to add at this stage except to note that the silver price did

turn lower once it hit resistance at 4.80. In general, the worst time to

be bullish on anything is following a sharp rally up to, but not through,

important resistance.

Update

on Stock Selections

Newmont

Mining (NYSE: NEM, ASX: NEM) has not been one of our favourite gold mining

companies over the past few years. However, as a result of the company's

good operational performance during the 4th quarter of last year, the substantial

shrinkage in the size of its hedge book late last year and early this year,

and the ability of the stock price to hold above important support during

the January-March pullback in the gold sector, our opinion changed during

the second half of March. If fact, we recommended NEM in the 24.50-25.00

range for anyone wanting exposure to major gold stocks. Newmont

Mining (NYSE: NEM, ASX: NEM) has not been one of our favourite gold mining

companies over the past few years. However, as a result of the company's

good operational performance during the 4th quarter of last year, the substantial

shrinkage in the size of its hedge book late last year and early this year,

and the ability of the stock price to hold above important support during

the January-March pullback in the gold sector, our opinion changed during

the second half of March. If fact, we recommended NEM in the 24.50-25.00

range for anyone wanting exposure to major gold stocks.

NEM's latest quarterly report, which

was released yesterday, has increased our bullishness. NEM is clearly now

a very well run company that offers good exposure to the spot gold price.

Furthermore, unlike some of the other high-profile North American gold

producers NEM is reasonable value at its current price.

As a long-term investment NEM looks

attractive at its current price. However, from a short-term technical perspective

the outlook is not particularly bullish. As the following chart shows,

NEM has just reversed lower from near its channel top. For this reason

we are going to take a small profit now on the NEM January-2004 $30 call

options added to the TSI Stocks List in early April. We'll look for an

opportunity to purchase some January-2005 NEM call options over the coming

months.

Lucent

(NYSE: LU) has broken decisively above important resistance at $2.00, projecting

a move up to $3.00-$3.50 over the next few months. Note, though, that a

pullback to around $2 to 'test' the breakout would not be surprising before

the next rally phase gets underway. We'll increase our sell-stop to $1.79. Lucent

(NYSE: LU) has broken decisively above important resistance at $2.00, projecting

a move up to $3.00-$3.50 over the next few months. Note, though, that a

pullback to around $2 to 'test' the breakout would not be surprising before

the next rally phase gets underway. We'll increase our sell-stop to $1.79.

American

Bonanza (TSXV: BZA) released excellent drill results on Tuesday. If we

have time we'll provide some details on these results in the next Weekly

Update. American

Bonanza (TSXV: BZA) released excellent drill results on Tuesday. If we

have time we'll provide some details on these results in the next Weekly

Update.

One of the things that interests us

about high-potential juniors such as BZA is that their stock prices are

not totally dependant on the gold price in that good drill results can

cause the prices of these stocks to rise even when the gold price is trending

lower. As such, they are generally not stocks that should be traded based

solely on a view of the gold price.

Copyright

Reminder

The commentaries that appear at TSI

are copyrighted material and may not be distributed, in full or in part,

without our written permission. In particular, please note that the posting

of extracts from TSI commentary at other web sites (for example, at discussion

boards) without our written permission is a breach of copyright.

Chart Sources

Charts appearing in today's commentary

are courtesy of:

http://stockcharts.com/index.html

http://www.futuresource.com/

|