|

- Interim Update 12th November 2003

Copyright

Reminder

The commentaries that appear at TSI

may not be distributed, in full or in part, without our written permission.

In particular, please note that the posting of extracts from TSI commentaries

at other web sites or providing links to TSI commentaries at other web

sites (for example, at discussion boards) without our written permission

is prohibited.

We reserve the right to immediately

terminate the subscription of any TSI subscriber who distributes the TSI

commentaries without our written permission.

Why the

Fed will have to hike

In the 22nd October Interim Update

we explained why we think the Fed will have to hike official interest rates

over the coming 12 months by more than the market is presently anticipating.

Then, in the 29th October Interim Update, we predicted that the Fed will

begin talking about the risks of rising inflation by the 28th January

FOMC Meeting. We are now going to revisit this matter because it is so

important and because we perceive a large mismatch between the consensus

view and what is actually going to happen.

Many of our readers would be familiar

with John Mauldin and his free newsletter that gets sent out to literally

millions of people each week. Mr Mauldin doesn't expect the Fed to raise

interest rates at all over the coming year so his view could not be described

as typical (the consensus view is that there will be a modest increase

in rates). However, his reasons for not expecting any rate hikes from the

Fed are representative of the wrong-headed thinking that appears to be

dominating interest rate discussions.

If you haven't already done so we suggest

that you read Mr Mauldin's latest analysis at http://www.2000wave.com/article.asp?id=mwo110803

for a 'take' on why the Fed won't hike next year. In summary, the argument

is that a) the Fed wants to see sustainable employment growth before hiking

rates, and b) the Fed is going to buy insurance for a growing economy in

the form of lower rates until after the November 2004 elections.

These arguments would be valid if

the short-term interest rate set by the Fed controlled the long-term interest

rates set by the market, that is, if keeping the Fed Funds Rate at a very

low level guaranteed that long-term interest rates would remain low. In

the real world, though, the opposite is true in that the Fed is typically

dragged along, 'kicking and screaming', by the bond market.

We've attempted to illustrate the lead-lag

relationship between the bond market and the Fed on the below chart of

the 30-year bond yield.

Point A on the chart corresponds to

the time when the trend for long-term interest rates turned higher in October

of 1998 while point B corresponds to the time when the Fed began to hike

short-term rates (June 1999). The difference between the two points --

9 months -- represents the time it took the Fed to respond to the changing

financial/economic environment.

Point C on the chart corresponds to

the time when the trend for long-term interest rates turned lower in January

of 2000 while point D corresponds to the time when the Fed began to cut

short-term rates (January 2001). The difference, in this case, was 12 months.

Currently, 5 months have gone by since

long-term interest rates turned higher (point E on the chart). If the Fed

follows the bond market with the same 9-12 month lag that characterised

the past two major monetary-policy shifts then the first rate-hike will

happen between March and June of next year.

We expect that the first official rate

hike will occur by March 2004 and that the Fed will be FORCED to hike rates

aggressively during the 6 month period leading up to the November 2004

presidential election. The reason they will be forced to hike rates is

that once inflation expectations get out of hand -- something that has

a good chance of happening next year due to the excessively easy monetary

policies of the past year -- it becomes counter-productive NOT to do so.

This is because long-term interest rates are pushed higher by rising inflation

expectations and long-term interest rates have a much greater effect on

the stock market, the real estate market and the economy than do short-term

interest rates. As such, at some point in the inflation cycle it becomes

necessary to increase official short-term interest rates in order

to quell the inflation fears and bring down long-term interest rates.

Further to the above, the argument

that short-term interest rates will remain low because the Fed wants them

to remain low makes no sense. The Fed will only have the option

of keeping short-term interest rates low for as long as long-term interest

rates remain near current low levels. And long-term interest rates will

only remain near current low levels for as long as inflation expectations

remain subdued. However, if we are right about what is going to happen

to the gold price, to commodity prices in general and to the US$ over the

next year then inflation expectations are absolutely NOT going to remain

subdued.

Funnily enough, whether or not the

Fed ends up having the option of keeping short-term interest rates near

current low levels for much longer will be determined, to a large extent,

by the actions of the Chinese and Japanese monetary authorities. There

are two reasons for this. First, the credit expansion that is raging away

in China is causing that country's demand for commodities to ramp-up at

a staggering pace. Unless the Chinese authorities are successful in slowing

the credit expansion and the resultant credit-induced boom within the next

few months, the CRB Index will burst above its 1996 peak and begin heading

towards its 1980 peak at a rapid rate. It doesn't take much imagination

to realise that this would put enormous downward pressure on bond prices

(upward pressure on long-term interest rates) throughout the world. Second,

long-term US interest rates would already be much higher if not for the

huge purchases of US Treasury Bonds and Agency Securities made by the central

banks of Japan and China over the past year.

Copper

Below is a weekly chart of copper futures.

When copper broke above resistance

in the 79-80 range 3 months ago it generated an upside target in the mid-90s,

a level that also roughly corresponded to the peak reached in September

of 2000. This target has been achieved and given the almost vertical rise

in the price that has occurred over the past several weeks it would be

normal for a pullback to begin from around the current level. A reasonable

target for such a pullback, assuming it does occur, would be the breakaway

gap at around 86. This would constitute a 40% retracement of the rally

from the May low to the recent peak.

There might be some short-term downside

risk in the copper market based primarily on technical factors and perhaps

a delayed reaction to planned increases in copper production, but taking

a 6-12 month view the risk/reward looks very favourable. A potential slowing

of Chinese demand for copper represents a risk and the Chinese monetary

authorities are already taking steps that could create such a slowdown.

However, once a credit expansion is in full swing -- as is the case right

now in China -- an extended period (many months) of concerted effort on

the part of the central bank is typically required to effect a sustainable

slowing in the rate of expansion. Therefore, over the next 6 months the

situation in China probably represents more of a threat to the 'shorts'

in the copper market than it does to the 'longs'. Also, the trend reversal

(from up to down) in the US money-supply growth rate isn't likely to have

a significant adverse effect on US economic growth until the second quarter

of next year, so on the whole the economic backdrop remains bullish for

copper (and the other base metals).

The US

Stock Market

Current Market Situation

No market-timing indicator works all

the time and over the past several months many of the popular indicators

of market sentiment have failed. For example, by June of this year many

of the sentiment indicators we follow, including the TSI Index of Bullish

Sentiment (a weighted index made up of the VIX, the 5-day moving average

of the equity put/call ratio, and the results of four sentiment surveys),

were suggesting that the stock market was close to an important peak. However,

although the market hasn't made much upside progress since that time it

has continued to work its way higher in defiance of persistently 'overbought'

readings. Note, on the below chart, that something similar occurred between

December of 1998 and July of 1999.

The apparent failure of sentiment indicators

over the past 6 months won't stop us from paying attention to such indicators

in the future. In fact, they will probably begin to work very well again

as medium-term market-timing tools shortly after most people become convinced

that they are of little value. The recent failure of these indicators does,

however, show that if liquidity remains high enough for long enough then

almost nothing else matters.

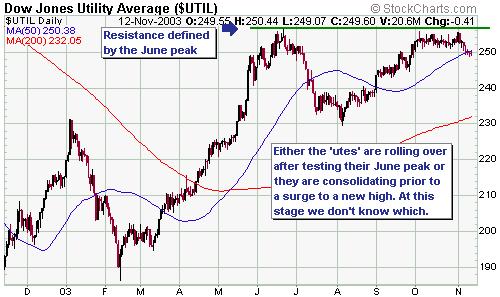

The stock market was generally quite

strong on Wednesday, but one of the most notable aspects of yesterday's

rally was the small decline in the Dow Utilities Average. This was

notable because the 'utes' tend to move with the combination of

stocks and bonds, so on a day such as yesterday during which both stocks

and bonds were up we'd have expected this particular sector to have fared

relatively well.

The below 1-year chart shows that the

Utilities Average is hovering just below important resistance, so this

might explain yesterday's lackluster performance. In any case, a decisive

move above the June high by the 'utes' would be a bullish omen for the

combination of US stocks and bonds whereas a failure to breakout to the

upside would be a bearish omen. In other words, an upside breakout in the

Utilities Average would warn that there was likely to be strength in US

stocks and bonds over the coming months or that the strength in

one market (stocks or bonds) was going to more than offset the weakness

in the other market over the coming months.

So far, this has been a strange week

because the US$ has confirmed last Friday's downward reversal by heading

lower while the stock market has moved back to near its recent highs. We

are not sure what to make of this. Anyhow, we are yet to see any cracks

in the stock market's bullish veneer.

Gold and

the Dollar

Current Market Situation

Wednesday's decisive move above $390

by the gold price suggests that our short-term target of $410-$420 will

be reached within the next few weeks. Also, as discussed in the latest

Weekly Update the daily close above $390 has created an intermediate-term

upside target of $460. It is possible that this higher target will also

be reached over the coming few weeks, but a more likely scenario is that

which we've outlined in the past (a move up to 410-420 followed by a 3-6

month consolidation followed by another rally).

Over the past several months our forecast

has been that a peak in the US$ gold price would coincide with a move in

the euro gold price to its long-term channel top (see chart below). In

order to reach the channel top over the next month the gold price would

need to move up to around 370 euros, but if the gold rally were to extend

into the first half of next year (as now seems likely) then a move to the

channel top would require a gold price of 380-390 euros. Looking at this

from a different angle, if we assume that the US$ gold price reaches its

$460 target at the same time that the euro gold price is hitting its channel

top, then the implied EUR/USD exchange rate at the next important gold

price peak would be 460/380 = 1.21.

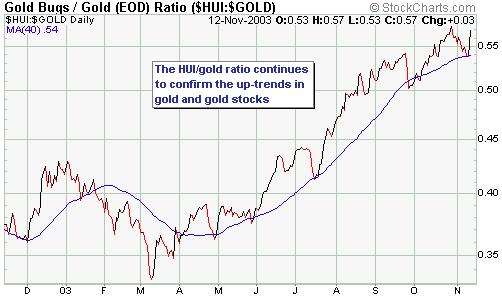

The HUI/gold ratio completed another

successful test of its 40-day moving average earlier this week before surging

on Wednesday, meaning that the upward trend in gold stocks relative to

the gold price remains intact. This, in turn, means that there is no sign

of imminent danger as far as the gold market is concerned.

As discussed in previous commentaries,

there are a few signs that growth-oriented investments are beginning to

get the upper hand over safety-oriented investments. However, a trend change

has not yet been confirmed. For example, the below chart of the gold/GYX

ratio shows that gold is continuing to cling to its up-trend relative to

the GYX (Industrial Metals Index).

Below is a weekly chart of the silver

price. By closing above resistance in the 5.15-5.20 range on Wednesday

silver brought our previously mentioned short-term target of 5.80 (the

one we discarded when the silver price dropped below 4.90 in early October)

back into play. In the TSI Stocks List we have exposure to silver via Western

Silver (TSX: WTC, AMEX: WTZ), Cardero Resource (TSXV: CDU) and Metallica

Resources (AMEX: MRB).

Update

on Stock Selections

During

the first 12-18 months of the gold-stock bull market our focus at TSI was

on the major and mid-tier gold producers. However, during the third quarter

of last year we made a decision to shift away from the larger companies

and to start focusing on the juniors. This decision was made because at

the market prices that prevailed at the time the risk/reward for many of

the junior gold companies was vastly superior to the risk/reward for their

larger counterparts. During

the first 12-18 months of the gold-stock bull market our focus at TSI was

on the major and mid-tier gold producers. However, during the third quarter

of last year we made a decision to shift away from the larger companies

and to start focusing on the juniors. This decision was made because at

the market prices that prevailed at the time the risk/reward for many of

the junior gold companies was vastly superior to the risk/reward for their

larger counterparts.

A result of this decision was that

by February of this year there were no large gold producers in the TSI

Stocks List. Also, with the exceptions of mid-tier producers Wheaton River

and Northgate the gold/silver section of the Stocks List has been totally

comprised of juniors over the past 9 months.

To some observers our strategy might

appear to be overly risky, but it's not. A single junior mining stock can

be a very risky speculation, but when we decided to shift our focus to

the juniors it was apparent that a carefully selected portfolio of, say,

10 junior stocks offered less risk (in addition to substantially

greater reward) than a portfolio of 10 large-cap stocks. This is because

substantial gold price increases were already built into the larger

stocks whereas many of the smaller stocks were under-valued based on the

current gold price. This, in turn, meant that there was large valuation

risk amongst the majors which generally didn't exist amongst the juniors.

For an example of what can happen when

an over-valued stock fails to live up to the lofty expectations that are

built into its stock price, take a look at the year-to-date performances

of Meridian Gold, Agnico Eagle and Royal Gold. These were generally not

perceived to be high-risk stocks, but they were high-risk stocks when they

were trading near their peaks because they were priced for perfection.

At the same time, many of the juniors were priced as though the gold price

was going to remain below $325 forever and thus, as a group, were less

risky.

The reason we originally decided to

shift our focus to the juniors is the same as the reason we are sticking

with the juniors. With gold trading at around $390 we have no interest

in buying stocks that already discount a $450-$500 gold price, which is

the case with most of the large and mid-size North American gold stocks.

If the gold price rises to $500 then these stocks would still show good

gains because equity investors would ramp-up their gold price expectations,

but if investors began to believe that a $450-$500 was unattainable over

the medium-term then these stocks would be vulnerable to a sizeable decline.

From risk/reward perspective, it makes

more sense to focus on those companies that are under-valued at the current

gold price. In other words, don't expect us to change tack anytime soon.

The same argument applies, by the way,

to the non-gold commodity stocks. Despite the huge run-ups in stock prices

over the past 2 months it is still very easy to find juniors that offer

exceptional value. In general, however, the majors have already gone a

long way towards discounting a brighter future for commodity prices.

We re-emphasise that there is often

considerable risk with any single junior resource stock and for

this reason the amount of money put into any one situation should be a

small percentage of your overall portfolio (a maximum of, say, 5%). As

mentioned above, though, this risk can be very effectively mitigated by

spreading your exposure across several companies.

Aquiline

Resource (TSXV: AQI) broke its short-term downtrend earlier this week and

has done enough to confirm that a correction low is in place. A daily close

above the hefty resistance that exists at C$0.90 would confirm that the

stock was on its way to a new high. Aquiline

Resource (TSXV: AQI) broke its short-term downtrend earlier this week and

has done enough to confirm that a correction low is in place. A daily close

above the hefty resistance that exists at C$0.90 would confirm that the

stock was on its way to a new high.

One

of the most under-valued junior gold stocks we know of is Patricia Mining

(TSXV: PAT). This company's Island Gold Project in Canada has an inferred

resource of 1.6M ounces plus a modern 650tpd mill and related infrastructure

(providing the ability to quickly move into production once reserves have

been proved up over the coming year). All this and PAT is being valued

by the market at only US$11M (around US$6.80 per ounce of gold in the ground). One

of the most under-valued junior gold stocks we know of is Patricia Mining

(TSXV: PAT). This company's Island Gold Project in Canada has an inferred

resource of 1.6M ounces plus a modern 650tpd mill and related infrastructure

(providing the ability to quickly move into production once reserves have

been proved up over the coming year). All this and PAT is being valued

by the market at only US$11M (around US$6.80 per ounce of gold in the ground).

We

continue to like NovaGold (TSX: NRI) and the NovaGold warrants (TSX: NRI.WT)

near current levels. We

continue to like NovaGold (TSX: NRI) and the NovaGold warrants (TSX: NRI.WT)

near current levels.

In

an e-mail sent to paid-up subscribers earlier today we added two more junior

gold stocks to the Stocks List and took profits on one of our existing

junior gold stocks. In

an e-mail sent to paid-up subscribers earlier today we added two more junior

gold stocks to the Stocks List and took profits on one of our existing

junior gold stocks.

We

plan to send an e-mail to paid-up subscribers on Friday to advise the addition

of at least one more non-gold junior resource stock to the List. We

plan to send an e-mail to paid-up subscribers on Friday to advise the addition

of at least one more non-gold junior resource stock to the List.

Chart Sources

Charts appearing in today's commentary

are courtesy of:

http://stockcharts.com/index.html

http://www.futuresource.com/

|