|

-- Weekly Market Update for the Week Commencing 3rd May 2004

Big Picture

View (Most recent update: 12 January 2004)

Here is a summary of our big picture

view of the markets. Note that our short-term views may differ from our

big picture view.

Bond yields (long-term interest

rates) bottomed in June of 2003 at around 4.2% and will move considerably higher during

2004 and 2005.

The stock market rally that

began in October of 2002 will end during the first half of 2004. The October-2002

bottom (775 for the S&P500) will be tested during 2005.

The Dollar will make an intermediate-term

bottom during the first half of 2004 in the vicinity of its 1995 low (a Dollar Index value of around 80) and

then rally for at least 6 months, but a long-term bottom won't occur until

2008-2010.

Gold will make an intermediate-term

peak during the first half of 2004 and then consolidate for at least 6

months, but a long-term peak won't occur until 2008-2010.

Commodities, as represented

by the CRB Index, will make an intermediate-term peak during the first

half of 2004 and then consolidate for at least 6 months, but a long-term

peak won't occur until 2008-2010.

Copyright

Reminder

The commentaries that appear at TSI

may not be distributed, in full or in part, without our written permission.

In particular, please note that the posting of extracts from TSI commentaries

at other web sites or providing links to TSI commentaries at other web

sites (for example, at discussion boards) without our written permission

is prohibited.

We reserve the right to immediately

terminate the subscription of any TSI subscriber who distributes the TSI

commentaries without our written permission.

China and Commodities

Over the past few months the

People's Bank of China has taken measures to reduce the rate at which

credit is expanding and to bring China's economic growth rate down to a

more sustainable level. And additional measures might be necessary

because year-over-year M2 (money supply) growth and import growth are

currently running at around 20% and 40%, respectively. However, it is

unlikely that these measures will be so heavy-handed as to cause the

economy to grind to a standstill and in all likelihood China will

consume a lot more commodities this year than it did last year. So, why

have the prices of industrial metals tumbled over the past few months?

The problem, we think, is simply that prices moved too high too fast

due to speculators fully embracing the idea that surging demand from

China was soon going to create an acute shortage of metals. As is often

the case, speculative enthusiasm pushed prices way beyond where they

would otherwise have been and set the stage for a subsequent plunge.

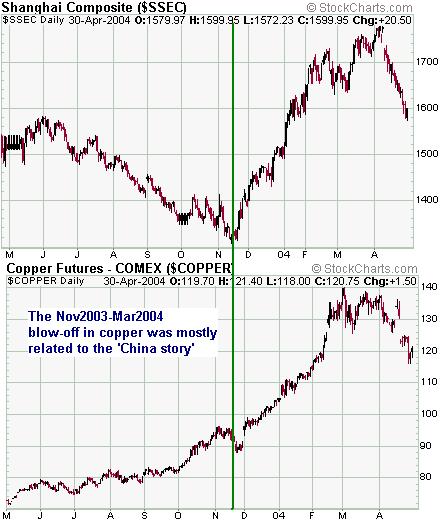

The relationship between the 'China story' and the run-up in metals'

prices can be seen by comparing charts of the copper price and the

Shanghai Composite Index. Notice, on the below chart, that copper was

moving higher in steady fashion until last November when the price of

everything China-related (copper included) suddenly took off.

Prior to last

November the main driver of the commodity bull market appeared to be

US$ weakness. We say this because during the two years leading up to

last November commodity prices did not gain very much when measured in

terms of the European currencies.

As far as the future is concerned, we don't think we've seen the last

of US$ weakness or the strong growth in China's demand for commodities.

That is, once the speculative 'China trade' is fully unwound the

factors that underpinned the bull-run in commodities over the past few

years should re-emerge to push prices upward.

On a side note, the measures that are being taken to slow-down China's

growth rate are not bearish for gold in any way. Unlike the industrial

metals, gold is counter-cyclical -- it tends to perform best when real

growth is sub-par. Gold's recent weakness is, we think, related far

more to the market's assumption that the Fed is about to shift away

from its pro-inflation policy than it is to the goings-on in China.

This assumption by the market is most likely incorrect, but it gained

traction thanks to the large size of the speculative long position in

gold futures.

Bonds

From a technical

perspective bonds look bearish in both the short and long-term. The big

picture is that the upward drift since last August's bottom looks like

a bear-market consolidation and the post-1998 downward trend in bond

yields appears to have been broken, while the small picture is that the

bond price has broken below a short-term trend-line (refer to the

following chart). The only significant support between the current

price and the August-2003 bottom is situated at the early-January low.

From a fundamental

perspective the outlook for bonds is also bearish, but from a sentiment

perspective the short-term outlook is bullish because the 'dumb money'

is betting heavily that bond prices will fall (the net-short positions

of small traders in 5-year and 10-year T-Note futures are near 7-year

highs). This simply means that any bond-friendly news has the potential

to cause an upward spike in the bond price because it would catch the

small speculators leaning in the wrong direction. This coming week we

have an FOMC Meeting on Tuesday and the monthly employment report on

Friday, so it is certainly a week with the potential to provide some

market-moving news.

We view the bond situation as a major risk for the stock market, with

further substantial weakness in bonds likely to cause substantial

weakness in the stock market. However, due to the potential for a sharp

snapback rally in bonds at some point in the near future we don't view

the bond market as a particularly attractive short sale.

The Stock

Market

Current Market Situation

When we logged on to the internet on Saturday morning to check what had

happened in the US markets on Friday night (here in China we are 15

hours ahead of New York) one of the first things we saw was the Reuters

headline: "Stocks Fall on Interest-Rate Hike Fears".

We then observed that interest rates had actually FALLEN during the day

and that the more interest-rate sensitive sectors of the market -- the

groups that usually perform the worst when the market is worried about

higher interest rates -- had OUT-performed those sectors that are LESS

vulnerable to higher interest rates. In other words, stocks might have

fallen on Friday but the evidence suggested that fear of higher

interest rates wasn't the main driver of the decline. All of which

reminded us of why we go out of our way NOT to read the explanations

for market action contained in the mainstream financial press.

One thing the market did last week was provide some clarity by negating

some recent short-term bullish developments. For example, the

S&P500 fell enough and the euro rallied enough last week to mark

the previous week's upside breakout in the S&P500/euro ratio as a

'head fake'.

As we look through

the charts of a lot of stock sectors, three examples of which are

included below, we find that the majority appear to either be in the

process of topping or on the verge of breaking below important support.

The Housing Index (HGX), for instance, looks like it is following a

similar path to the one followed by Pan American Silver (PAAS) several

weeks ago and discussed in the 19th April Weekly Update.

One thing to be wary

of is that on a short-term basis the market is very oversold. In

particular, the McClellan Oscillators for both the NYSE and the NASDAQ

closed at extremely low levels on Friday. We would downplay the

significance of the NYSE McClellan Oscillator (MO) right now because it

is being made to look worse than it really is by the fact that there

are such a large number of interest-rate sensitive stocks trading on

the NYSE (every time interest rates have ticked higher over the past

few months most of the rate-sensitive stocks have fallen and this has

caused the NYSE MO to reach extremely low levels). However, whenever

the NASDAQ MO (chart included below) has dropped to current levels over

the past three years the NASDAQ Composite Index has always been trading

higher 4 weeks later.

Further to the above,

we suspect that a short-term bottom will be put in place during the

first half of this week. Looking beyond the next few weeks, though, the

situation looks bearish. The sector and individual stock charts we have

reviewed suggest downside targets over the next few months that are, on

average, about 15% below current levels. This would equate to about

8700 for the Dow Industrials and 940 for the S&P500.

This week's

important US economic events

| Date |

Description |

Monday May 03

|

ISM Index

Construction Spending

|

| Tuesday May 04 |

FOMC Meeting

Factory Orders

|

| Wednesday May 05 |

ISM Non-Manufacturing Index

|

| Thursday May 06 |

Productivity and Costs

|

| Friday May 07 |

Employment Report

ECRI Future Inflation Gauge

Consumer Credit

|

Gold and

the Dollar

More thoughts on the US$ short position

In the 26th April Weekly Update we discussed the idea that there would

be the equivalent of a huge short-covering rally in the US$ due to US

individuals scrambling to pay-down their debts. Our conclusion was that

the idea didn't hold much water, primarily because the Fed's ability to

create new dollars is unlimited.

Bob Hoye provides another view on this interesting topic at http://www.gold-eagle.com/editorials_04/hoye040604.html. Mr Hoye's belief, which is based on hundreds of years of historical evidence, is that "following

a period of great financial recklessness all that is needed to make the

senior currency relentlessly strong is to have most of the debt

expanded during the boom to be contracted in the senior currency." Investors should therefore be aware that "the U.S. dollar can, despite policymakers opposing ambition, become chronically strong."

We agree with Mr Hoye's assessment that a sustained contraction of

credit (deflation) within the US would probably cause the US$ to

strengthen, but we remain long-term BEARISH on the US$ because we do

not think a sustained contraction of credit is at all likely. Our

reasoning is that in the past when persistent strength in the senior

currency followed a period of great financial recklessness the senior

central bank did not have anywhere near as much power in the field of

money/credit creation as today's Federal Reserve. This is because the

senior currency has, over the past few hundred years, generally been

convertible into gold and/or silver at a fixed rate, meaning that there

were stringent LIMITS on the senior central bank's ability to inflate.

But no such limits exist at the present time. Furthermore, we doubt

that the provider of the world's senior currency has ever been as

reliant on foriegn investment in-flows as the US is today.

Interestingly, My Hoye is long-term bullish on BOTH the US$ and gold,

once again based on the historical evidence. Once again, though, direct

comparisons with other bubble-bursts of the past few centuries might

not be appropriate because when the senior currency was officially tied

to gold then gold would naturally be a beneficiary of DEflation, rather

than INflation (as deflation pushed the relative value of the senior

currency higher it would also push the relative value of gold higher

due to the official link between the two). Under the current monetary

system, though, we would not be long-term bullish on gold unless we

were also long-term bearish on the US$.

Where we agree with Mr Hoye is that the belief in a 1970s-style

scenario became too popular during the final quarter of last year and

the first quarter of this year, leading to a speculative blow-off and

subsequent plunge in those investments that are perceived to benefit

from higher inflation. There are some similarities between the present

time and the first half of the 1970s, but for the record we are not

expecting the remainder of this decade to closely follow the path of

the 1970s. For one thing, the current bull market in the housing sector

-- housing is typically a major beneficiary of inflation -- would

almost certainly NOT survive a substantial rise in interest rates. For

another, the excesses have built up to such a level that it won't be a

matter of simply wheeling in a Volcker-like Fed Chairman at some point

later this decade to make the hard decisions and set the stage for the

next 20-year growth period. Instead, the end game this time around is

probably going to involve a complete revamping of the monetary system.

Current Market Situation

The Dollar

Below is a chart of the British Pound in terms of the euro. Prior to

last August pound/euro had been a reliable leading indicator of the

US$, but it made so many false moves between August and December of

2003 that we almost gave up on it. At the end of the day, though, the

final break above the 60-day moving average (the one that occurred in

early January) led the upturn in the Dollar Index by a few weeks, which

is exactly what it should do. And last week pound/euro broke back below

its 60-DMA, providing a signal that if a peak for the Dollar isn't

already in place it is not far away.

Below is a chart of

the Dollar Index. The recent price action looks similar to what

occurred when the US$ was peaking last August/September and is

therefore consistent with the message from the pound/euro ratio

discussed above. A short-term peak is probably in place for the US$.

The Dollar Index

achieving two consecutive closes below its 50-day moving average would

provide additional evidence that a peak is in place. Even if this

happened, though, it wouldn't necessarily indicate that a major decline

was underway. As previously advised, we do not expect that long-term

support at around 80 on the Dollar Index will be breached this year.

Also, the recent break by the gold price to a new low for the year

suggests that we have not yet reached the point where another large

downward leg in the Dollar's bear market is about to begin. Rather, a

drop by the US$ to test its February low would appear to be the most

likely outcome over the next few months.

Gold

Before gold faked us out in March by rallying above $420, our

expectation was that a correction low would occur at $380 +/-$3. Our

reasoning, at the time, was that a) a significant move below 390 would

be needed to shakeout the weak hands and set the stage for the next big

advance, and b) the area just above the May-2003 peak was a logical

place for a low.

As can be seen on the following chart, gold achieved our original

target last week. However, because it rallied to a marginal new high

for the year in the mean time it is now in a technically weaker

position than it would have been had the drop to the 377-383 range

occurred during the first half of March.

When gold broke below

390 it created a technical target of 350, but given the likelihood that

the US$ has just peaked we doubt that 350 will be seen in the near

future. On the other hand, we haven't yet seen strength in the gold

mining stocks relative to the bullion and this is something that

usually occurs prior to gold making a low. A test of last week's low

therefore looks likely. Ideally, gold will drop back to test last

week's low while gold stocks begin to advance.

Gold Stocks

To say that the gold sector is presently 'oversold' would be an

understatement. In fact, the HUI's daily Relative Strength Index (RSI)

has only reached its current level on two other occasions in its

history (the HUI was created in mid 1996). As the below chart shows,

the prior two occasions when this happened occurred during the bear

market years of 1997 and 1998 and in both instances gold stocks

experienced a sharp rebound over the ensuing 1-3 months. The below

chart also shows that the daily Moving Average Convergence Divergence

(MACD) is now lower than it has ever been.

The HUI/Gold

Oscillator (the HUI/gold ratio divided by its 40-day moving average),

our own momentum indicator, is currently below where it was at the

October-2002 and March-2003 bottoms, but is still above where it was at

the July-2002 bottom.

The bottom line is

that the gold sector is about as oversold as it gets in either bull or

bear markets. This doesn't mean that it can't go lower in the

immediate-term (it is certainly possible for an extremely oversold

market to become even more oversold). It does mean, though, that

regardless of whether gold stocks are destined to trade much lower at

some point over the coming year (not our expectation, by the way), they

are likely to trade well above current levels at some point over the

coming 3 months.

As far as the next 1-2 weeks are concerned, we think the odds are

evenly matched as to whether the HUI commences a snapback rally

immediately or first drops to major support at around 160 and then

rallies. Whatever the case, the gold sector is probably close to its

low for the year. We certainly didn't anticipate a major low occurring

at this time, but it looks like we are going to get one.

Our longer-term view, which is supported by a mountain of fundamental

and technical evidence, is that gold and gold stocks are immersed in

bull markets that will extend through to the end of this decade.

On a side note, if you ever get yourself in a position where you NEED

the market to rally in order to sidestep a financial problem then you

must reduce your exposure regardless of what anyone thinks is going to

happen in the future. That is, you should always be in a position where

you can AFFORD to be wrong.

The above is just another way of saying that any trade/investment you

make must pass the "sleep test", meaning that if your exposure to the

market is so large that your sleep gets interrupted when the market

moves against you then you should reduce your position regardless of

what you, or anyone else, thinks is going to happen to the market in

the future. This is because you will only have a fighting chance of

consistently making the right decisions if you are able to approach the

markets with a relaxed and unemotional demeanor.

Update

on Stock Selections

In

last week's commentary we said we would exit our position in USPIX (an

inverse index fund) with the aim of re-establishing a FULL position

following either a rally above 1600 or a technical failure by the NDX.

Last week's decisive close below 1450 constitutes a technical failure,

but given the high probability of a bounce in the market over the next

few weeks we have decided against re-purchasing a full position

immediately (if the market bounces then USPIX will trade lower).

Instead, we are going to once again build up a position in two or three

steps with the initial position being purchased at Monday's closing

price. The reason we want to buy an initial position now, as opposed to

waiting until the market moves higher, is that there is no guarantee

that the expected rally will materialise. In

last week's commentary we said we would exit our position in USPIX (an

inverse index fund) with the aim of re-establishing a FULL position

following either a rally above 1600 or a technical failure by the NDX.

Last week's decisive close below 1450 constitutes a technical failure,

but given the high probability of a bounce in the market over the next

few weeks we have decided against re-purchasing a full position

immediately (if the market bounces then USPIX will trade lower).

Instead, we are going to once again build up a position in two or three

steps with the initial position being purchased at Monday's closing

price. The reason we want to buy an initial position now, as opposed to

waiting until the market moves higher, is that there is no guarantee

that the expected rally will materialise.

We will continue to provide ideas at TSI on ways to potentially profit

from what will probably be a sizeable decline in the stock market over

the next six months, but as mentioned many times in previous

commentaries we think the best approach for most people is to simply

maintain a hefty cash reserve. In this way you ensure that you will be

in a position to take full advantage of the buying opportunity that

will emerge following a large decline but are not in a position where

an upward move in the market will cost you anything (there is no

CERTAINTY that the market will fall over the next several months, it's

just our assessment of the most LIKELY outcome).

Corvis

Corp. (NASDAQ: CORV) released its March quarter financial report last

Friday. It was a good report -- generally better than expected and

proving that the company's business plan is coming together -- but

didn't do much for the stock price due to the weakness in the broad

market. We liked Corvis as an investment (not a trade) at $1.80 and we

like it even more in the 1.50s. Corvis

Corp. (NASDAQ: CORV) released its March quarter financial report last

Friday. It was a good report -- generally better than expected and

proving that the company's business plan is coming together -- but

didn't do much for the stock price due to the weakness in the broad

market. We liked Corvis as an investment (not a trade) at $1.80 and we

like it even more in the 1.50s.

Aquiline

Resource (TSXV: AQI) announced positive metallurgical test results for

its Calcatreu gold project on Friday. Importantly, the company also

confirmed that more drilling results and an updated resource

calculation would be announced within the next two weeks. Aquiline

Resource (TSXV: AQI) announced positive metallurgical test results for

its Calcatreu gold project on Friday. Importantly, the company also

confirmed that more drilling results and an updated resource

calculation would be announced within the next two weeks.

Chart Sources

Charts appearing in today's commentary

are courtesy of:

http://stockcharts.com/index.html

http://www.decisionpoint.com/

|