|

-- Weekly Market Update for the Week Commencing 3rd November 2003

Big Picture

View

Here is a summary of our big picture

view of the markets. Note that our short-term views may differ from our

big picture view.

Bond yields (long-term interest

rates) reached a major low in June of 2003 and will trend higher until

at least mid 2004.

The US stock market will reach

a major bottom (well below the October-2002 low) during 2004.

The Dollar commenced a bear

market in July 2001 and will continue its decline during 2003 and 2004.

A bull market in gold stocks

commenced in November 2000 and will continue during 2003 and 2004.

Commodity prices, as represented

by the CRB Index, will rally during 2003 and 2004 with most of the upside

occurring in 2004.

Inflation

versus Inflation Expectations

For a few years now the US Treasury

has been issuing what are commonly known as TIPS (Treasury Inflation-Protected

Securities). The idea behind these securities is to offer investors a way

to buy US Government bonds without the need to take on the risk that the

bond will fall in value due to inflation. And this supposed 'inflation

protection' is achieved by regularly adjusting the principle amount of

each bond based on changes in the CPI. For example, if you buy one of these

inflation-protected bonds and the CPI increases by 3% during the ensuing

12 months then the principle amount of the bond -- the amount that would

be due to you at the eventual repayment date -- would be increased by 3%.

Furthermore, future interest payments would be based on the revised principle

amount.

The thing is, TIPS aren't really inflation-protected

because the CPI is not inflation or a proxy for inflation. It is not even

an accurate representation of the effects of inflation. The CPI

is simply a number that is concocted by the government each month in such

a way as to minimise inflation expectations and social security payments

(most social security payments are linked to the CPI). However, because

most people do incorrectly associate the CPI with inflation the performance

of 'inflation-protected' securities relative to the performance of non-inflation-protected

securities can provide us with useful information.

Below is a chart showing the ratio

of the Vanguard Inflation-Protected Securities Fund (VIPSX) and the US

30-year T-Bond. The line on this chart rises when the TIPS -- represented

here by the VIPSX -- are out-performing the regular government bonds. Out-performance

by TIPS is, in turn, an indication that investors are becoming more concerned

about inflation. Obviously, the market is a lot more concerned about inflation

than the Fed pretends to be.

The US

Stock Market

Current Market Situation

Over the recent past our commentaries

have been heavily loaded with discussion on gold, gold stocks, and currencies,

with only scant attention being paid to the overall stock market. This

is because we tend to devote the most space in each TSI commentary to the

markets that are presently the most interesting. In this context, "interesting"

means trending strongly or appearing to be close to an important trend

change.

The US stock market has recently been

anything but interesting. In fact, the market has essentially gone nowhere

since early June; a lethargic performance that is reflected in the multi-year

low just posted by the Volatility Index. Now, a long period of inactivity

in the market is invariably followed by a period of dramatic action and

the current situation will not be an exception in this regard. In other

words the current tedium will be followed by a period of considerable excitement,

most likely as a result of a decline that starts out looking like 'nothing'

and ends up causing widespread panic as one support level after another

gives way.

Sentiment is currently overtly bullish

and valuations are generally at bubble-peak levels. This means that market

risk is extremely high, but it doesn't mean that a large decline is necessarily

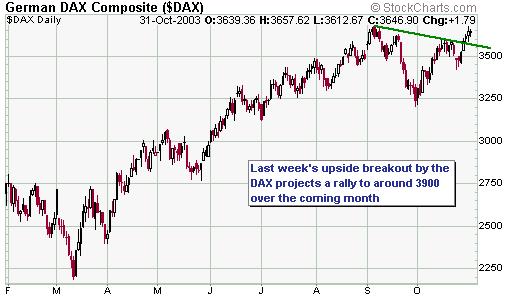

going to get underway during the next few weeks. In fact, last week's upside

breakout by the German stock market (see chart below) shifts the odds in

favour of new recovery highs being seen in the US stock market over the

coming month.

Natural Gas Stocks

In the 22nd September Weekly Update

we mentioned that the Natural Gas Index (XNG) was precariously positioned

near its channel bottom. This, in itself, wasn't a problem, but a break

below the channel bottom would have been a warning that a sizeable correction

was underway.

From a technical perspective the situation

is unchanged because the XNG has remained in an upward trend but is once

again testing trend-line support (see chart below).

The stocks of natural gas companies

have a stronger positive correlation with the overall stock market than

with the natural gas price so the ability of the XNG to remain within its

upward-sloping channel will be determined, to the greatest extent, by what

happens to the overall market. Furthermore, the ability, or otherwise,

of the XNG to hold above trend-line support in the short-term will give

us a clue as to what to expect from the overall market. For example, a

rebound in the XNG over the coming week would have short-term bullish implications

for the overall market.

This week's important economic events

| Date |

Description |

| Monday Nov 03 |

Construction Spending

ISM Index |

| Tuesday Nov 04 |

No significant events |

| Wednesday Nov 05 |

Factory Orders

ISM Non-Manufacturing Index |

| Thursday Nov 06 |

Q3 Productivity and Labour Costs |

| Friday Nov 07 |

Employment Report

Consumer Credit

ECRI Future Inflation Gauge |

Click

here to read the rest of today's commentary Click

here to read the rest of today's commentary

|