|

|

What's happening

with gold stocks?

We've received a lot of e-mails asking

us to explain the muted reaction of gold stocks to the recent surge in

the gold price. So, here's what we think.

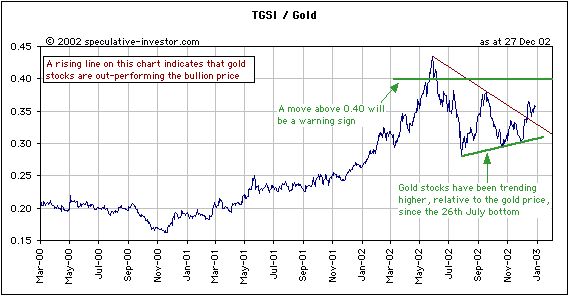

First, although many people have obviously

been disappointed by the recent lack of action in the gold shares, and

in particular by the failure of most gold shares to move above their May

highs, gold shares have significantly out-performed the bullion over the

past 4 weeks. In fact, the TSI Gold Stock Index (TGSI) is now almost 20%

higher, relative to the gold price, than it was 4 weeks ago. Furthermore,

as the following chart of the ratio of the TSI Gold Stock Index and the

gold price clearly shows, gold stocks have been trending higher relative

to the bullion price since the late-July bottom and the ratio recently broke

upwards out of a consolidation pattern.

Second, gold stocks are clearly much

cheaper today relative to the gold price than they were at the May peak.

But, if the prices of the major gold stocks at the May peak were discounting

a gold price of well over $400 (many of them were, as we said at the time),

even though the spot gold price at the time was only about $325, is it

really so strange that the recent move by the gold price from the 320s

to the 340s resulted in stock prices that are generally lower than they

were at the May peak? After all, today's gold stock prices are based more

on where investors expect the gold price to be in the future than on where

the gold price is today. So, rather than asking why gold stocks have generally

not yet exceeded their May highs even though the gold price is $20 above

its May peak, it makes more sense to ask why gold stock investors were

so incredibly optimistic in May.

Third, as discussed above the major

determinant of gold stock prices is investor expectations regarding the

future gold price. Equity investors clearly got it wrong in May and the

result was a bona fide crash in gold stock prices in July. The real issue

now is whether gold stock investors have got it right this time, or if

they are either overly optimistic or overly pessimistic.

Our view is that the current general

level of gold stock prices is about right assuming a gold price of $350,

but that investors are not optimistic enough with regard to the future

gold price. Also, within the gold sector there are pockets of extreme over-valuation

(extreme optimism) and extreme under-valuation (extreme pessimism). In

rough terms, the North American favourites such as GG and MDG are very

expensive (they have been the beneficiaries of investor optimism) and we

have no interest in buying or holding these stocks. The major SA gold stocks

such as HMY, AU and GFI are fairly valued based on the current gold price.

These stocks should be held, but we aren't interested in doing any new

buying at current prices. Many of the junior gold stocks are under-valued

based on the current gold price and are absolute steals if we assume that

the gold price will move at least $50 higher over the coming 6 months.

This is the area where all new buying should be focused.

We don't think the gold rally will

end until the enthusiasm for gold stocks approaches the extremes reached

in May, that is, until the TGSI/gold ratio moves up to near its May peak

(TGSI, by the way, is an index made up of Newcrest Mining, Lihir Gold,

Anglogold, Gold Fields, Harmony Gold, Barrick Gold, Goldcorp, Newmont Mining

and Placer Dome, with each stock given equal weight). So, until the TGSI/gold

ratio signals excessive speculation in gold shares, 'buying the dips' in

the high-quality junior gold stocks should continue to work.

Regular financial market forecasts

and

analyses are provided at our web site:

http://www.speculative-investor.com/new/index.html

One-month free trial available.

|

|

|