|

-- for the Week Commencing 15th April 2002

Forecast

Summary

The

Latest Forecast Summary (no change from last week) The

Latest Forecast Summary (no change from last week)

Big Picture

View

Here is a summary of our big picture

view of the markets. Note that our short-term views may differ from our

big picture view.

Bond yields (long-term interest

rates) will move higher during 2002.

The US stock market will make

new bear market lows in 2002.

The Dollar commenced a bear

market in July 2001, but will rally to a secondary peak during the first

half of 2002 before beginning a major descent.

A bull market in gold stocks

commenced in November 2000 and is likely to extend into 2003.

Commodity prices, as represented

by the CRB Index, will rally during 2002 and 2003.

The oil price will resume its

major uptrend during the first half of 2002.

Considerable

Slack

"Inflation declined during the recession

and seems poised to decline further as growth accelerates in an economy

with considerable slack," he [Dallas Federal Reserve Bank President

Robert McTeer] said in the Dallas Fed's annual report.

The above really is an incredible statement

from the president of the Dallas Federal Reserve Bank. There was apparently

so little slack in the economy during 1999 that the Fed felt compelled

to raise short-term interest rates a number of times, yet today, with consumer

spending and the overall level of indebtedness having grown considerably

over the past 3 years, the economy supposedly has "considerable slack".

We wouldn't argue that there is considerable slack in those few sectors

of the economy where capacity was expanded at a phenomenal rate during

the Fed-sponsored NASDAQ bubble (eg, the telecom industry), but the absence

of "slack" that led to an energy crisis during 2000-2001 has certainly

not been addressed.

The 'lack of slack' in the US economy

is evidenced by the surge in energy prices over the past 5 months despite

the continuing strength of the US$ (only the recent gains were Middle East

related). It is also evidenced by the behaviour of the bond market.

Below is a chart showing the yield

on the 10-year T-Note during the 6-month period following the 1990-1991

recession. At the end of a recession there is typically a lot of 'slack'

in the economy and this 'slack' enables long-term interest rates to fall

during the initial stages of recovery. This is what happened after the

early-90s recession.

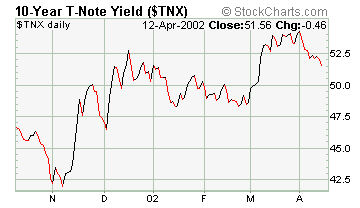

Below is a chart showing the yield

on the 10-year T-Note over the past 6 months. If there really was "considerable

slack" in the economy and inflation really was "poised to decline further"

then interest rates would still be trending lower. That is clearly not

the case.

When McTeer uses the word inflation

he is referring to an increase in the CPI. If we define inflation correctly

(as an increase in the supply of money) then the current US inflation rate

is 9.1%. This inflation will eventually put upward pressure on some prices,

although anyone who truly believes that the CPI accurately represents cost

of living changes, or is even an honest attempt to accurately represent

cost of living changes, deserves a gullibility award. Ironically, if we

define our terms correctly then McTeer's statement that inflation is "poised

to decline further" is actually true since the money supply growth rate

is poised to decline further.

Commodities

At the beginning of this year we forecast

that commodity prices, as represented by the CRB Index, would perform well

in 2002 relative to the stock market (as represented by the S&P500

Index). Our concern at the time, however, was that the CRB Index would

out-perform the S&P500 Index and still not yield a good absolute return.

This concern was based on the positive correlation between the CRB and

the S&P500 that had been evident over the past 2 years.

Below is a chart comparing the S&P500

and the CRB Index. Since mid-2000 the CRB Index has followed the S&P500

with a lag of 0-6 weeks. At some point we expect this relationship to breakdown

and for commodity prices to start trending higher as stock prices trade

sideways. It is quite possible, however, that a major rally in commodity

prices will have to wait until after the stock market has reached its ultimate

low (the stock market's ultimate low is expected to occur late this year).

The CRB Index has fallen sharply over

the past 2 weeks but has not yet closed below its 200-day moving-average.

Also, the stocks of commodity producers have held up quite well despite

the recent weakness in the stock market and commodity prices. As such we

are treating the recent decline as a bull market pullback but may need

to ramp-down our expectations for commodity prices if the CRB Index continues

to move with the S&P500.

The US

Stock Market

Small caps versus large caps

The upward trend in the NYSE's advance-decline

line is often cited as a reason to be bullish. The advance-decline line's

upward mobility stems primarily from the strength in small-cap stocks which,

in turn, is also regularly cited as a reason to be bullish.

It is easy to be bullish at the top

and today's fervent enthusiasm for small cap stocks may be a sign that

this sector of the market is close to a peak. The following chart of the

S&P600 Index (an index of small cap stocks) certainly suggests that

this might be the case. This is a close-up view of the chart we showed

a couple of weeks ago to illustrate the broadening top (a sequence of higher

highs and lower lows) that appears to be forming. The chart suggests that

the downside risk in this popular sector of the market now vastly outweighs

the upside risk.

Whereas small-cap stocks appear to

be nearing an important peak, large-cap stocks reached a 'bubble peak'

back in 2000 and have been working their way lower ever since. Furthermore,

the decline in large-cap stocks looks like it still has much further to

go.

Below is an 8-year chart of General

Electric, the largest of the large-caps. GE peaked during the third quarter

of 2000, making it one of the last of the large-caps to do so. Last week's

drop in the GE stock price on the back of disappointing earnings news suggests

that the next phase of the stock's major downtrend has begun.

Current Market Situation

It is almost time to move to the bullish

side of the fence as far as the short-term is concerned. Here's why:

1. As indicated by the following chart,

the 10-DMA of the equity put/call ratio has moved up to a high level (telling

us that option traders are, as a group, fearful). Note that the chart scale

is reversed so that the line falls as the put/call ratio rises. Furthermore,

there is a pronounced divergence between the equity put/call ratio and

the OEX (S&P100 Index) put/call ratio. As mentioned in the past, the

equity put/call ratio is a good contrary indicator (meaning that equity-options

traders, as a group, are invariably caught leaning the wrong way at important

turning points) while the OEX put/call ratio is not a good contrary indicator

(OEX-options traders tend to be right as often as they are wrong). In fact,

it is usually worth paying attention when the equity put/call ratio is

at one extreme while the OEX put/call ratio is at the opposite extreme,

as is currently the case. When these large divergences occur the OEX traders

are almost always correct. The OEX-options traders have just taken a bullish

stance while the equity-options traders have taken a decisively bearish

stance.

2. The Arms Index 10-DMA has just hit

one of its highest levels of the past 40 years. High Arms Index readings

occur when declining volume on the NYSE is high relative to the number

of stocks that are declining, that is, they occur when most of the selling

pressure is concentrated in a relatively small number of stocks.

3. The June bond futures have rallied

and have now built a 4-point cushion between their current level and their

December low. A further gain of another point or so is all we can reasonably

expect from this bear market rally, but the immediate danger of a collapse

in bonds has been removed.

It is almost time to turn bullish,

but it is not yet time. While the high Arms Index reading tells

us that a substantial rally is likely to begin during the next few weeks,

the rally could begin from a MUCH lower level. For example, the extreme

Arms Index reading during the second half of August last year was followed

by a 20% plunge in the NYSE Composite Index over the ensuing 4 weeks. Unless

we get the emotional equivalent of September-11 a 20% plunge from current

levels over the next 4 weeks won't occur, but a drop of another 5%-10%

is certainly possible.

Three other reasons to remain very

cautious at this time are:

1. The Japanese stock market remains

in a short-term downtrend.

2. The large commercial traders have

not yet begun to cover their huge short position. In other words, the smart

money is betting on a further decline.

3. Volatility remains at a very low

level. Low volatility is not, in itself, a concern since volatility could

increase from its low levels via either a sharp rally or a sharp decline.

However, a sharp rally is not likely going to begin with the commercials

net-short to the tune of 91,000 contracts.

We will continue to hold our June QQQ

put options for now, but an opportunity to close-out this bearish position

and move to a long position in the QQQ is likely to present itself during

the next few weeks.

Traders and investors should continue

to accumulate the stocks of commodity producers during weakness. These

stocks are likely to be amongst the leaders once the current decline runs

its course and a rally begins.

This week's important economic/market

events

| Date |

Description |

| Monday April 15 |

No significant events |

| Tuesday April 16 |

CPI

Industrial Production |

| Wednesday April 17 |

Trade Balance |

| Thursday April 18 |

Leading Economic Indicators |

| Friday April 19 |

No significant events |

Gold and

the Dollar

Platinum versus Gold

Although they are both precious metals

the prices of platinum and gold respond in very different ways to different

economic and monetary environments.

Below is a long-term chart of the platinum/gold

ratio. The chart was taken from http://www.cairns.net.au/~sharefin/Markets/Master.htm,

an excellent resource for financial market data. We've added notes and

lines to the chart to illustrate (labour?) the point we are about to make.

Platinum tends to out-perform gold

during prolonged periods of economic growth or perceived monetary stability

and to under-perform gold during prolonged periods when confidence in the

economy and the financial system is deteriorating. This relationship occurs

due to gold's status, a status that has developed over thousands of years,

as the ultimate form of money outside the financial system.

With reference to the above chart we

can see that the platinum/gold ratio plunged (the gold price rocketed higher

relative to the platinum price) during the early-1970s and bottomed, in

late-1974, at around the same time that the stock market was hitting its

major low. It is also apparent that the platinum/gold ratio trended higher

from 1982 through to 2000, reaching what looks like a bubble peak in late-2000

at around the same time that the stock market bubble began to lose air

at a rapid rate.

If the decline in the stock market

and real economic growth over the past 18 months represents nothing more

significant than an interruption to the 1990s' boom then the platinum/gold

ratio will move above its 2000 peak over the coming 2 years. However, if

we have just witnessed the end of an era characterised by, amongst other

things, growing confidence in government, central banks and the fiat money

system, then the year 2000 gave us a multi-decade peak in the platinum/gold

ratio.

Our analyses of all the financial markets

over the past few years strongly suggest that the level of confidence in

government and government-sponsored money made a secular peak in 2000 and

is now in a secular downtrend. As such, the downturn in the platinum/gold

ratio in late-2000 represents a major trend reversal.

The above chart shows that trends in

the platinum/gold ratio, once set in motion, tend to continue for at least

4 years. In other words, we should expect the gold price to trend higher

relative to the platinum price until at least the second half of 2004.

This means that although some exposure to platinum (via the stocks of platinum/palladium

producers) is desirable we should, based on the evidence at hand, continue

to substantially overweight gold relative to platinum in our investment

portfolios.

There are certainly going to be extended

periods over the next few years - periods when the prospects for economic

growth temporarily take a turn for the better - when platinum will out-perform

gold. However, the trend in the ratio is now DOWN and we will not be surprised

if gold trades higher than platinum at some point over the next 2-3 years.

The S&P500 in terms of gold

Below is another look at the S&P500/gold

ratio that we show from time to time. This chart suggests that a quick

move into the 320s by the gold price is still a distinct possibility before

an extended (2-3 month) correction gets underway. This is because the Wave

3 decline does not appear to be over, meaning that the prospect of a drop

to, or below, the September-21 low lives on. Assuming the S&P500 doesn't

completely fall out of bed the only way this can happen is via a surge

in the gold price.

Last September's closing low for the

ratio was 3.32. If the S&P500 falls to 1070 (a reasonable short-term

objective) then an S&P500/gold ratio of 3.32 would require a gold price

of $322.

Current Market Situation

The euro is still unable to break its

downtrend, but this can't get any closer (see chart below). If we traded

currencies (we don't) we'd be more inclined to be short the euro than long

the euro at this time because the channel looks like it is going to hold

for now. However, we would quickly move to a long position following a

daily close of 88.40 or higher (basis the June futures).

In the 8th April Weekly Update we mentioned

that the A$ looked vulnerable to a sharp fall. The A$ continues to trend

higher but the short-term downside risk remains high (longer-term we are

very bullish on the A$). The below chart shows one reason for our concern.

The chart shows percentage movements in the A$ and the S&P500 since

the beginning of 2000. Notice that the A$ and the S&P500 have moved

in the same direction throughout this period with the exception of a couple

of brief divergences. One such divergence has occurred over the past month

with the A$ moving higher as the S&P500 has moved lower. This divergence

will probably be closed and since we expect more downside in the S&P500

in the short-term we think it will be closed via a drop in the A$.

The Dollar Index is more likely to

move higher than lower over the next few weeks, but the downside risk is

greater than the upside risk. What we mean by this is that while a near-term

rally is likely we would expect such a rally to halt at, or below, the

low-120s (2%-3% above the current level), whereas a reasonable initial

downside target once the inevitable decline does get started is around

105 (11% below the current level).

Anglogold generated a bit of excitement

in the gold world over the past week when they announced that further steps

were being taken to reduce the extent of their gold price hedging. However,

unless Anglogold's senior executives are the world's worst traders the

hedge buy-backs would have already occurred when the announcement was made.

In other words, if your goal is to get the best possible price you don't

announce your intention to buy before you buy. As such, the direct effect

of Anglogold's buy-backs on the gold price would have been 'in the market'

before the announcement was made. What wasn't in the market was the psychological

effect of the news.

Anglogold's change of policy and Newmont's

takeover of NDY mean that 2 of the 4 largest forward-sellers of gold over

the past 10 years are no longer sources of downward pressure on the gold

price. The stock prices of the other two - Barrick Gold and Placer Dome

- will continue to under-perform until the managers of these companies

change their hedging policies or are replaced by those who will make the

necessary changes.

Our views on gold and gold stocks are

unchanged from those outlined over the past few weeks. While a move into

the 320s is possible in the short-term, the bearish traders' commitments

and recent speculative frenzy in gold stocks tell us that a medium-term

peak is forming. However, we expect to see much higher prices for gold/silver

bullion and our favourite gold/silver stocks during the second half of

this year.

The Middle East

http://www.debka.com/

is a good site to visit on a daily basis to keep up with the latest developments

in the Middle East.

Update

on Stock Selections

Now is not a good time to be buying

gold stocks, buy anyone who feels an irresistible urge to buy at this time

should steer clear of the major producers and focus on the small exploration

companies that still represent good value in terms of their market caps

relative to their in-ground resources. These stocks should hold up better

during the coming correction.

Although the SA gold stocks generally

sell at large discounts to their NA counterparts due to the perception

of political risk, in one important respect - earnings - they are far less

risky. When Harmony and Gold Fields report their first quarter earnings

we suspect that their current stock prices will seem fully justified.

|