|

-- Weekly Market Update for the Week Commencing 29th December 2003

Big Picture

View (Most recent update: 18 August 2003)

Here is a summary of our big picture

view of the markets. Note that our short-term views may differ from our

big picture view.

Bond yields (long-term interest

rates) reached a major low in June of 2003 and will trend higher until

at least mid 2004.

The US stock market will reach

a major bottom (well below the October-2002 low) during 2004.

The Dollar commenced a bear

market in July 2001 and will continue its decline during 2003 and 2004.

A bull market in gold stocks

commenced in November 2000 and will continue during 2003 and 2004.

Commodity prices, as represented

by the CRB Index, will rally during 2003 and 2004 with most of the upside

occurring in 2004.

Copyright

Reminder

The commentaries that appear at TSI

may not be distributed, in full or in part, without our written permission.

In particular, please note that the posting of extracts from TSI commentaries

at other web sites or providing links to TSI commentaries at other web

sites (for example, at discussion boards) without our written permission

is prohibited.

We reserve the right to immediately

terminate the subscription of any TSI subscriber who distributes the TSI

commentaries without our written permission.

Bonds

So far, it looks like the typical

post-bubble pattern

A market that has just reached a 'bubble

peak' typically follows a sequence that begins with an initial sharp decline

that bottoms about 2 months after the bubble peak. A multi-month rebound

to a secondary (lower) peak then occurs, but this rebound turns out to

be the calm before the storm because it is followed by a large and lengthy

decline.

After bonds made what looked, to us,

like a bubble peak in June of this year our expectation was that they would

end up following something similar to the above-described sequence with

an initial bottom most likely occurring in August and a secondary peak

most likely occurring during the final quarter of 2003. In fact, in the

16th July Interim Update we compared the final run-up and subsequent collapse

in the NASDAQ100 Index (NDX) during 2000 with this year's upside blow-off

and subsequent collapse in the US bond market.

There is no reason why today's post-bubble

T-Bond will necessarily follow exactly the same path as that taken by the

NDX during 2000 (there will always be enough differences between the current

market action and prior market action to keep most traders in the dark).

However, the below chart shows that the paths have, to date, been remarkably

similar (in the below chart comparison the March 2000 peak in the NDX is

lined up with the June 2003 peak in the T-Bond).

Up until the past few weeks the twists

and turns of the post-bubble bond price have roughly matched the twists

and turns of the post-bubble NDX, but a difference is now emerging. Specifically,

at this stage of its bear market the NDX had just embarked on the second

leg of its bear market (the first leg being the initial sharp decline following

the bubble peak) while the T-Bond is still rebounding from its initial

drubbing. This difference is probably not significant, though, because

there is no fixed duration for the rebound that follows the initial sharp

decline. For example, the NDX rallied for about 3.5 months after reaching

an initial low in May of 2000 whereas the Dow Industrials Index rallied

for almost 6 months after reaching its initial bear market low during the

crash of 1929. In other words, it would not be unprecedented for the rebound

in the T-Bond to continue into the first quarter of 2004. What we can say,

at this stage, is that the T-Bond does appear to be following the typical

post-bubble pattern, which means that a break of the short-term up-trend

shown on the above chart is likely to be followed by a large and lengthy

decline.

Central bank support

Central banks -- mainly those of Japan

and China -- have provided a great deal of support to the US bond market

over the past year as a byproduct of their attempts to manage currency

exchange rates. And this support is likely to continue until the inflationary

effects of 'currency management' are perceived to be troublesome or until

the US$ stops falling.

In the absence of the massive buying

of US bonds on the part of Asian central banks that has occurred and continues

to occur, the US T-Bond price would be much lower (long-term interest rates

in the US would be much higher) and the Fed would most likely have already

begun to hike the official interest rate. As things currently stand, though,

one of the economy's built-in safety devices -- the bond market -- has

been temporarily disabled. This, in turn, is making it possible for gold

and commodity prices to move higher than would otherwise be the case. Why?

Because the way the world has worked, up until now, is that large rallies

in commodity prices have led to substantial rises in long-term interest

rates and rising long-term interest rates have prompted the Fed to tighten

monetary policy. Tighter monetary policy eventually brings about a reduction

in the demand for commodities and commodity prices begin to fall. In this

respect rising commodity prices have, during previous cycles, sown the

seeds of their own downward reversal. However, in today's world the aggressive

buying of US bonds by the Bank of Japan et al prevents long-term interest

rates from responding to rising commodity prices in the normal way. One

of the most important limiters of commodity-price rallies has therefore

been temporarily removed.

We say "temporarily removed" because

if commodity prices continue to rise then at some point private-sector

selling of bonds will overwhelm central-bank buying or the Asian central

banks will come to the realisation that the inflationary effects of their

bond-buying outweigh any benefits they hope to achieve.

Now, the Bank of Japan and the other

influential central-bank supporters of the US bond market are only accumulating

massive holdings of US bonds as a result of their efforts to prevent their

own currencies from rising relative to the US$. Foreign central bank support

for US bonds would therefore evaporate -- allowing US Treasuries to trade

based on their own dismal fundamentals -- if the US$ were to rebound or

simply stop falling. In other words, in the current topsy-turvy financial

environment the worst thing that could happen to the US bond market is

a stabilisation of the Dollar. If the Dollar were to stop falling, even

for just a few months, then bonds would have a lot of catching up to do

(to get from their present artificially-elevated level to where they should

be based on economic realities).

Oil and Bonds

Over the past two years the T-Bond

price has followed the oil price with a lag of 3-4 months. Therefore, the

recent upside breakout in the oil price is a bullish omen for bonds assuming

the aforementioned positive correlation between bonds and oil remains in

effect.

We expect that the positive correlation

will remain in effect and that some follow-through to the upside by the

oil price would eventually (after a lag of a few months) help push the

bond price higher. However, we are more than a little skeptical with regard

to the sustainability of oil's recent upside breakout. This is because

the main driver of strength in the US$ oil price appears to be US$ weakness,

which means that a rebound in the US$ would likely result in a drop in

the oil price. This is significant because a US$ rebound will probably

commence in the near future.

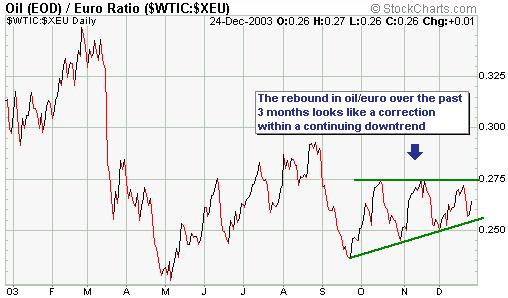

We say that the recent strength in

the oil price is mostly a function of US$ weakness because there is no

evidence of strength when the oil price is measured in terms of a strong

currency. The below chart of the oil price in terms of the euro illustrates

this point.

Now compare the above oil/euro chart

with the below GYX/euro chart (GYX is an index of industrial metals prices).

The industrial metals have been trending higher against the strong currencies

as well as the weak currencies, so there is clearly a lot more to the bull

market in the metals than just US$ weakness (meaning that the bull market

won't be de-railed by a US$ recovery).

Conclusion

There are more than the usual number

of crosscurrents affecting the bond market (and, therefore, interest rates)

at the present time, but at this stage we don't see any need to adjust

our intermediate-term bond and interest rate forecasts. Our expectation

continues to be that the next big move in the bond market will be to the

downside (roughly in line with the typical post-bubble pattern) and that

rising long-term interest rates will force the Fed to do what they don't

want to do (increase the Fed Funds Rate).

The greatest influence on US bond prices

over the next several months is likely to be the US$ as further dollar

weakness will result in foreign central banks absorbing a large quantity

of US bonds while a US$ rebound will remove this central bank support and

allow bonds to fall under the weight of their own over-valuation. If the

US$ does remain weak we doubt that this weakness and the resultant central

bank buying of US bonds could reverse the long-term trend in the bond market

from down to up, but it could extend the current counter-trend move.

The US

Stock Market

Current Market Situation

The below chart of the S&P500/gold

ratio shows the downward-sloping channel that originated during the early

part of 2000. S&P500/gold has successfully tested the top of this long-term

channel on two occasions over the past 6 months and remains 'channel-bound'.

While a longer-term chart of S&P500/gold

shows an on-going downward trend, a 1-year chart (see below) reveals some

bullish potential. In particular, the decline since the July peak looks

more like a consolidation pattern within a continuing intermediate-term

up-trend than the early stages of a new intermediate-term downtrend.

We are going to be watching the S&P500/gold

ratio more closely than usual over the next few weeks because it would

not require much movement in the S&P500 relative to gold to generate

an important upside breakout or to provide some evidence that the longer-term

downward trend remains in force. To be specific, a move above 2.75 would

break both the short-term downward trend and the 4-year downward trend

whereas a move below 2.58 would negate the bullish potential suggested

by the shorter-term chart.

The below chart needs no explanation,

but we'll provide one anyway. When the stock market was moving lower during

the first quarter of 2003 the NDX/Dow ratio was moving higher. As stated

at TSI at the time, this divergence suggested that the S&P500's test

of its October-2002 low was going to be successful. At the current time

a similar divergence is on the go except that now NDX/Dow is drifting lower

even though the stock market appears, on the surface, to be strong. In

our view this is a sign that the market is very close to an important peak.

The market will probably move a bit

higher over the coming week because the short-term trend is up and we are

in a seasonally strong time of the year. However, we will consider any

strength over the next 1-2 weeks that does not eliminate the above-described

divergence to be an invitation to increase the size of our bearish bet.

This week's important economic events

| Date |

Description |

| Monday Dec 29 |

No significant events |

| Tuesday Dec 30 |

Consumer Confidence

Existing Home Sales |

| Wednesday Dec 31 |

No significant events |

| Thursday Jan 01 |

Markets closed for New Year |

| Friday Jan 02 |

ECRI Future Inflation Gauge

ISM Index |

Click

here to read the rest of today's commentary Click

here to read the rest of today's commentary

|